personal property tax car richmond va

The City of Richmond has two exemption options in addition to the Commonwealths Personal Property Tax Relief Act PPTRA which can be granted for motor vehicles. Ad a tax advisor will answer you now.

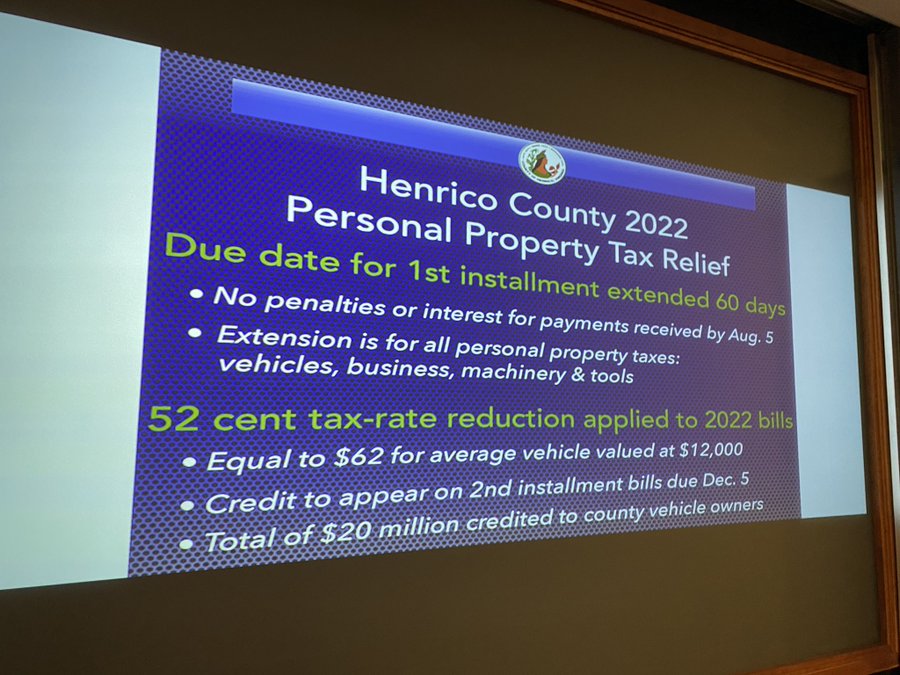

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE.

/do0bihdskp9dy.cloudfront.net/05-04-2022/t_b8750cc79d184cc4ae927c5aabf4f7b9_name_file_1280x720_2000_v3_1_.jpg)

. The Personal Property tax rate for 2021 is 4 per 100 of assessed value. Virginia allows localities to tax the personal property of residents. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required.

Does Your Vehicle Qualify for Personal Property Tax Relief. Questions answered every 9 seconds. Due to system maintenance the DMV website will be unavailable on Sunday May 29 from 1200 am.

Broad Street Richmond VA 23219. To help vehicle owners the Fairfax County Board of Supervisors approved 15 tax relief for personal property taxes as part of their FY 2023 budget markup. For most people this means automobiles trucks trailers boats motorcycles and recreational vehicles.

Create a Personalized Plate. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Personal property tax richmond va due date.

Vehicle personal property tax richmond va. Calculate personal property relief. If you have questions about your personal property bill or would like to discuss the value.

To qualify for the Personal Property Tax Relief a vehicle must. Yearly median tax in Richmond City. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Pay Personal Property Taxes. Personal property tax car richmond va. As of December 31 st of the year preceding the tax year for which assistance is requested the.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. This is an ad valorem tax based on the value of the vehicle. What seems a large increase in value may actually turn into a tiny increase in your property tax bill.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Monday - Friday 8am - 5pm Mayor Levar Stoney. 350100 x 10000 35000.

Reduce the tax by the relief amount. Offered by City of Richmond Virginia. Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD.

Thoroughly determine your actual property tax applying any exemptions that you are allowed to have. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

49 for 2020 x 69480 34045. The tax is assessed by the Commissioner of the Revenue and collected by the Treasurer. Clarke County uses the National Automobile Dealers Association NADA annual guide for the trade-in value of vehicles.

Personal Property Registration Form An ANNUAL filing is required on all. Mailing Address PO Box 283 Williamsburg VA 23187. Personal Property Taxes are billed once a year with a December 5 th due date.

In city of richmond the reassessment process takes place every two years. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Apply the 350 tax rate. Prorated Tax If you buy or sell a vehicle during the year the vehicle will be subject to a prorated tax.

Richmond City has one of the highest median property taxes in the United States and is. At this stage you better solicit for help from. Condition and Mileage Adjustments.

105 of home value. The personal property tax is calculated by multiplying the assessed value by the tax rate. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value.

226 for 2021 x 35000 7910. Box 27412 Richmond VA 23269. Develop a New License Plate in Va.

Below you will find the forms you need to receive property tax relief for your vehicle as well as frequently asked questions about the individual. Personal Property Tax. The rate is set annually by the York County Board of Supervisors in the month of May.

Hours Monday - Friday 8 am. Other guides are used for. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Example Calculation for a Personal Use Vehicle Valued at 20000 or Less. Assessed value of the vehicle is 10000.

Virginia S Personal Property Taxes On The Rise 13newsnow Com

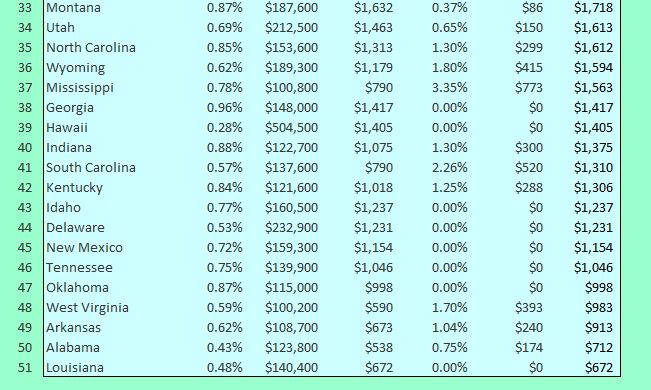

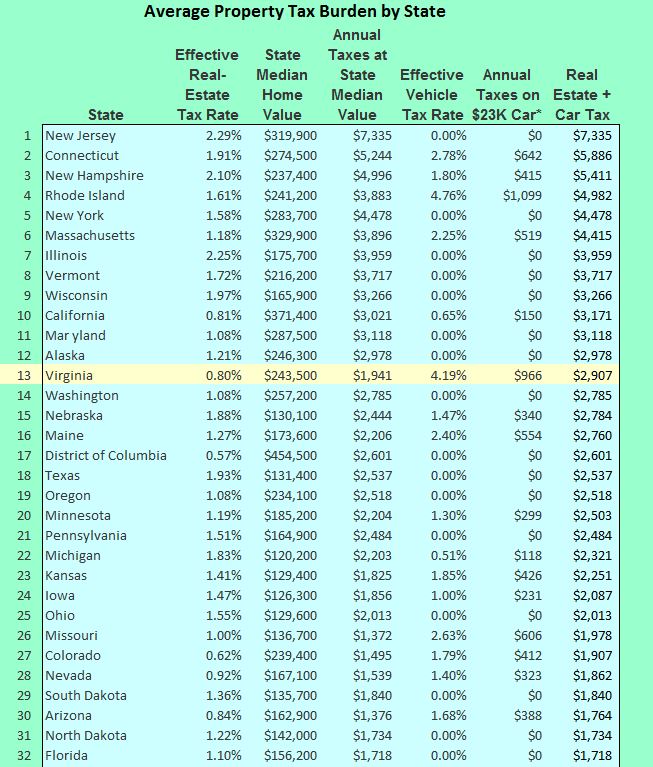

Property Taxes How Much Are They In Different States Across The Us

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Pay Online Chesterfield County Va

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

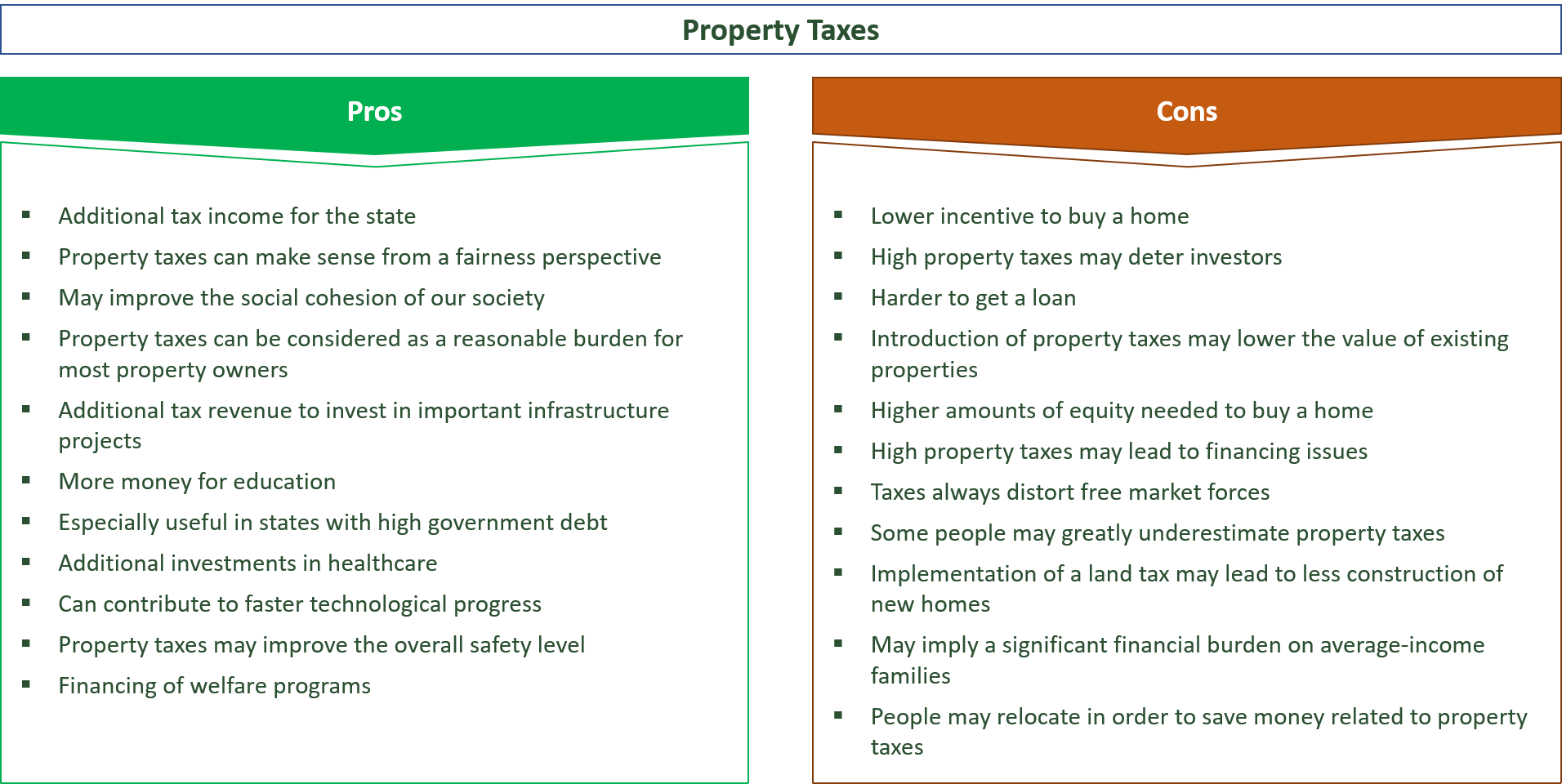

28 Key Pros Cons Of Property Taxes E C

How Your Property Tax Is Calculated Youtube

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

/do0bihdskp9dy.cloudfront.net/05-04-2022/t_b8750cc79d184cc4ae927c5aabf4f7b9_name_file_1280x720_2000_v3_1_.jpg)

Henrico County Working On Tax Relief Plan Following Personal Property Tax Hike

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Soaring Home Values Mean Higher Property Taxes

Many Left Frustrated As Personal Property Tax Bills Increase

Year End Tax Planning 2012 For Small Business Essay Topics Essay Math Worksheet

Personal Property Tax Assessments Howstuffworks

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist